With dedicated barcode scanning features, you can also ensure accurate, real-time inventory and order tracking, timely inventory rotation, and fewer human errors with decreased time-consuming manual tasks. Whether you’re using FIFO, LIFO, accurate cost, or some other inventory management method, Extensiv can help you streamline and optimize inventory management, warehousing, and shipping processes. And, in some cases, FIFO could https://x.com/BooksTimeInc actually decrease profit margins, especially during inflation or when inventory costs increase.

How the FIFO Inventory Method Works

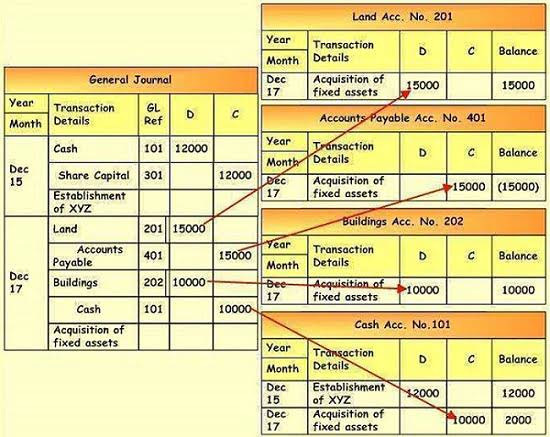

In contrast with FIFO, there is no matching of historical purchase costs. The weighted average method removes cost subjectivity by blending purchase prices. However, it can mask erosion of inventory value during inflationary environments. This shows the cost flow matching sales with oldest inventory costs first using FIFO.

- Many companies choose FIFO as their best practice because it’s regulatory-compliant across many jurisdictions.

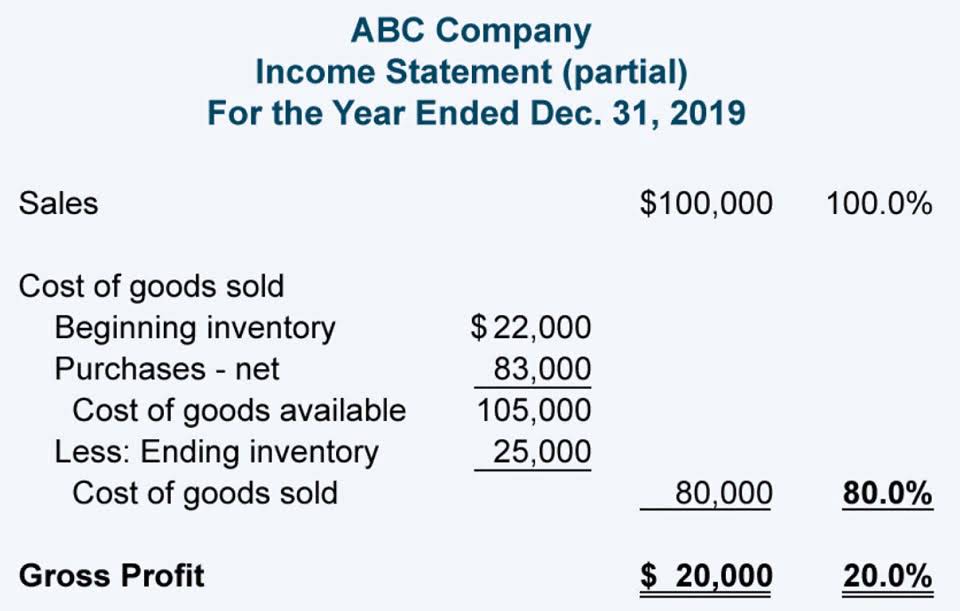

- The higher inventory value also lowers the cost of goods sold as a percentage of sales, increasing the gross profit margin.

- By understanding how the FIFO method works, businesses can more accurately track inventory costs over time.

- The goods that you first purchased will be the first ones to go to COGS upon sale.

- FIFO assumes that assets with the oldest costs are included in the income statement’s Cost of Goods Sold (COGS).

What’s the difference between FIFO and LIFO?

Nonetheless, both comply with GAAP standards and offer viable options for inventory accounting. This determines the balance sheet inventory asset value using FIFO cost assumptions. The ending inventory would be the remaining 50 units from the February 1st purchase valued at $12 per unit, or $600. We’ll explore how the FIFO method works, as well as the advantages and disadvantages of using FIFO calculations for accounting.

What Is LIFO?

Also, consider arranging your stock storage locations to make older inventory items easily accessible to help your teams pick and dispatch those first goods. Fulfillment software tools–like warehouse management system (WMS) software–designed for inventory slotting optimization, slotting algorithms, and dynamic location assignments may also be beneficial. You can come across several valuation methods for your business –including FIFO, LIFO, and the total average cost. However, the method that you choose should suit your business while being followed with consistency.

- We’ll explore how the FIFO method works, as well as the advantages and disadvantages of using FIFO calculations for accounting.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- You would multiply the first 10 by the cost of your newest goods, and the remaining 5 by the cost of your older items to calculate your Cost of Goods Sold using LIFO.

- LIFO does the opposite – the most recently acquired goods are expensed first.

- When calculating their cost of goods sold under FIFO, the 2,000 wristbands bought for $1.70 each and $1.30 each will be included, but not the 1,000 wristbands for $2.00 each.

- In periods of falling inventory costs, a company using FIFO will have a lower gross profit because their cost of goods sold is based on older, more expensive inventory.

- The oldest bars in her inventory were from batch 1 so she will count 100 at the unit cost of batch 1, $2.00.

- FIFO is calculated by adding the cost of the earliest inventory items sold.

- The costs of buying lamps for his inventory went up dramatically during the fall, as demonstrated under ‘price paid’ per lamp in November and December.

- The ending inventory at the end of the fourth day is $92 based on the FIFO method.

- This is because even though we acquired 30 units at the cost of $4 each the same day, we have assumed that the sales have been made from the inventory units that were acquired earlier for $5 each.

- That leaves you with 500 units in our ending inventory, valued at $2 per unit.

- When Susan first opened her pet supply store, she quickly discovered her vegan pumpkin dog treats were a huge hit and brought in favorable revenue.

Suppose the number of units from the most recent purchase been lower, say 20 units. We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit). Here’s a summary of the purchases and sales from the first example, which we will use to calculate the ending inventory value using the FIFO periodic system.

The gumballs at the bottom of the machine were likely the first ones added. When you insert a coin and turn the knob, those gumballs at the bottom, which went in first, will be the ones that come out first. The gumballs remaining in the https://www.bookstime.com/ machine at the end of the period—your inventory—are the gumballs that were added last. The goods that you first purchased will be the first ones to go to COGS upon sale. Since older inventory costs are typically lower due to inflation, COGS under FIFO is lower.

FIFO’s Representation of Ending Inventory on the Balance Sheet

With proper documentation, you can directly match cost of goods sold to the actual purchase costs of inventory sold first in first out method formula during the period. This also allows you to accurately determine the cost basis of ending inventory. However, the inventory accounting differences between FIFO and LIFO mean that FIFO typically results in higher taxable income. So while FIFO may improve financial reporting metrics, it can also increase a company’s income tax burden. The more recent $1.50 cost would show up on the balance sheet as ending inventory. Good inventory management software makes it easy to log new orders, record prices, and calculate FIFO.

Understanding Just in Case Inventory: A Comprehensive Guide for Ecommerce Businesses

Maximizing resources can also lead to a reduction in waste and tangible cost savings with minimal losses. Additionally, FIFO can positively influence inventory management techniques and enhance storage space utilization for logistics providers that support these businesses. The first-in first-out (FIFO) method is an inventory management process based on the principle that your oldest inventory items are the first to use or sell. It’s similar to how customers are served in a queue or line in a store based on their arrival order. The company management would now like to review the cost of items sold. With the help of the FIFO formula or method, they will analyse how much every item cost them for production.